eCommerce fraud continues to rise as online shopping grows across regions, devices, and payment methods.

Fraud is no longer limited to stolen credit cards. It now includes fake disputes, account takeovers, refund abuse, and organized scam networks.

Many merchants underestimate fraud because the losses appear in different places. They show up in refunds, chargeback fees, blocked customers, support time, and lost trust.

This report outlines 20 core eCommerce fraud statistics and explains their real-world implications for business.

Top highlight

- Global eCommerce fraud losses reached $48 billion in a single year.

- Merchants lose around 3% of total eCommerce revenue to fraud on average.

- Fraud losses can rise to 5% of revenue in high-risk markets.

- Total fraud losses between 2023 and 2027 are projected to exceed $343 billion.

- Friendly fraud accounts for 36% of all eCommerce fraud cases.

- Account takeover attempts increased by over 300% year over year.

- 70% of card fraud losses come from card-not-present transactions.

- Merchants lose $207 for every $100 of fraud after indirect costs.

- Latin America loses up to 20% of eCommerce revenue to fraud.

- North America accounts for 42% of global fraud value.

The scale of the problem

eCommerce fraud has moved from an occasional risk to a constant cost of doing business. As online sales grow, fraud scales with them.

Even when fraud rates appear stable, total losses continue to rise as transaction volume increases each year.

Fraud also spreads across payments, accounts, refunds, and customer behavior, which makes the full impact harder to track and control.

Global losses

1. Global eCommerce fraud losses reached $48 billion in a single year.

2. Merchants lose an average of 3% of their total eCommerce revenue to fraud.

These numbers reflect direct payment fraud. They do not fully include customer churn, blocked real orders, or brand damage.

For many merchants, a 3% loss equals or exceeds their net profit margin, making fraud a growth limiter.

Regional differences

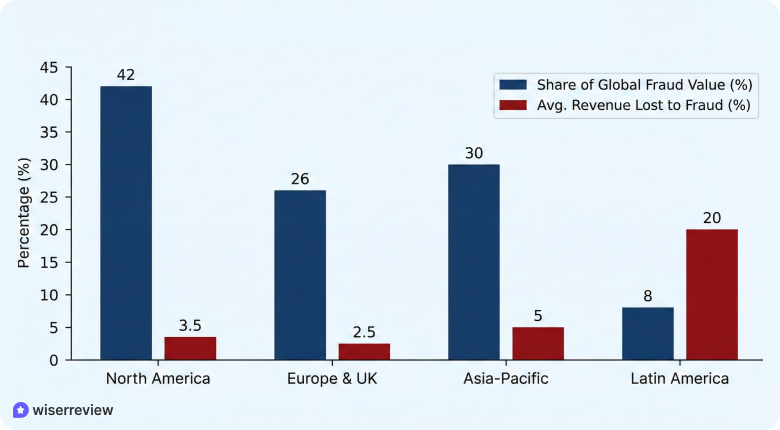

3. North America accounts for about 42% of the global eCommerce fraud value.

4. Latin America loses up to 20% of its eCommerce revenue to fraud, the highest impact globally.

Different regions face varying levels of fraud pressure. High-volume markets lose more money overall, while emerging markets lose a much larger share of revenue.

Payment habits, enforcement strength, and consumer behavior all influence these gaps.

| Region | Share of Global Fraud Value | Avg. Revenue Lost to Fraud | Key Risk Pattern |

|---|---|---|---|

| North America | ~42% | 3–4% | High volume, ATO, friendly fraud |

| Europe & UK | ~26% | 2–3% | Strong authentication |

| Asia-Pacific | Large share | ~5% | Cross-border exposure |

| Latin America | Smaller share | Up to 20% | High domestic fraud |

Hidden/indirect costs

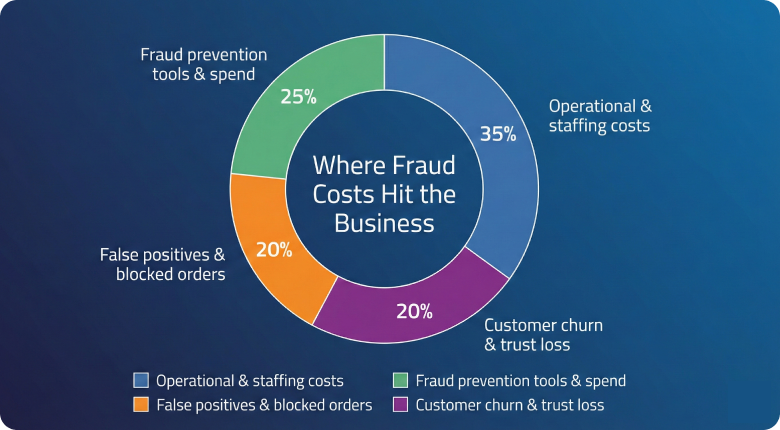

5. For every $100 lost to fraud, merchants lose about $207 after indirect costs.

Indirect costs include chargeback fees, shipping, inventory loss, customer support time, payment penalties, and blocked legitimate customers.

These losses span teams and tools, which is why many businesses underestimate the actual cost of fraud.

Types of fraud trending

eCommerce fraud continues to evolve as checkout flows, payment methods, and customer behavior change.

Stolen cards remain common, but newer fraud methods cause more damage and are harder to prevent.

Identity misuse, fake disputes, and organized scams drive most modern losses.

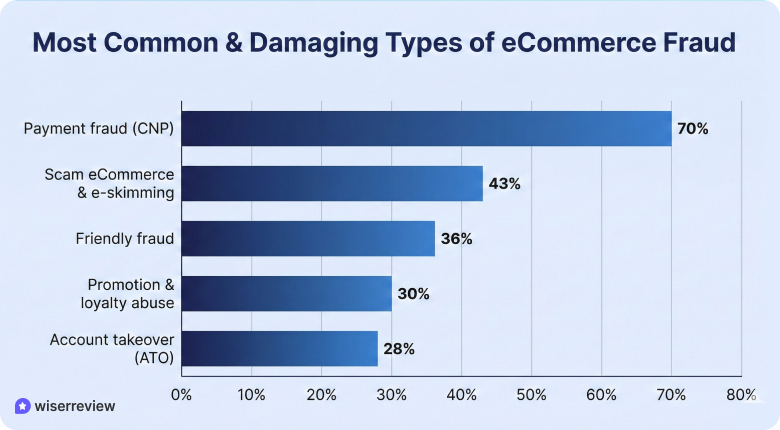

Payment-fraud (card-not-present, stolen cards)

Payment fraud remains the most common entry point for online fraud.

Card-not-present transactions are easy to abuse because the card is never physically verified.

Stolen card data moves quickly through underground markets and gets tested across many stores.

6. Around 70% of all card fraud losses come from card-not-present transactions.

7. Online card fraud costs the US alone over $10 billion in losses each year.

Even merchants with basic fraud checks remain exposed if authentication is weak or risk rules are outdated.

Friendly fraud & first-party misuse

Friendly fraud happens when real customers dispute valid purchases.

This includes false “item not received” claims, forgotten subscriptions, and buyers abusing refund policies.

These cases are complex to fight because banks usually side with the cardholder.

8. Friendly fraud now accounts for about 36% of all eCommerce fraud cases.

9. Between 50% and 61% of chargebacks are due to legitimate transactions.

This type of fraud quietly drains revenue and inflates chargeback ratios, even for trusted brands.

Account takeover (ATO) & identity-based fraud

Account takeover fraud targets customer accounts instead of cards.

Fraudsters use stolen login credentials obtained through phishing or data breaches.

Once inside an account, they place repeat orders using saved cards and addresses.

10. Account takeover attempts increased by over 300% year over year during peak periods.

11. ATO represents roughly 27–29% of reported eCommerce fraud incidents.

Because these orders appear to be normal customer behavior, detection is difficult without robust identity verification.

Scam-ecommerce & e-skimming

Scam eCommerce sites and skimming attacks fuel many other types of fraud.

Fake stores collect payments without shipping goods, while skimming scripts steal card data during checkout on real sites.

12. About 43% of eCommerce businesses report phishing or scam attacks targeting customers.

13. Skimming and fake stores supply stolen data used in payment fraud and ATO attacks.

These scams damage customer trust and often affect multiple merchants at the same time.

Promotion/coupon abuse & loyalty fraud

Promotions attract abuse as much as buyers. Fraudsters exploit weak limits on discounts, free shipping, refunds, and loyalty points. This fraud blends into regular activity and often goes unnoticed.

14. Around 30% of merchants report fraud tied to coupons, promotions, or refund abuse.

15. Return and loyalty fraud continue to rise as organized groups scale operations.

Over time, this abuse inflates marketing costs and reduces the actual return on promotions.

All your reviews in one place

Collect reviews, manage every response, and display them where they matter most.

Start Free →Business impact & merchant metrics

Fraud affects far more than chargebacks and refunds. It changes how merchants spend money, how teams operate, and how customers experience the brand.

Many of the most significant impacts are reflected in day-to-day metrics rather than in fraud dashboards.

Fraud detection & prevention spend

Merchants now spend a growing share of revenue just to control fraud. This includes software tools, payment controls, monitoring systems, and dedicated staff.

16. Many merchants spend up to 10% of revenue on fraud prevention and management.

Fraud-related costs have grown faster than eCommerce revenue in recent years.

As fraud tactics evolve, prevention becomes a fixed operating cost rather than a one-time setup.

False positives and trade-offs

Stopping fraud often means blocking real customers. False positives occur when legitimate orders are flagged or declined by fraud systems.

17. Some merchants reject 5–10% of legitimate orders due to fraud controls

False declines can reduce conversion rates and repeat purchases

Every blocked real order creates lost revenue, support tickets, and frustration. Merchants must balance fraud risk against growth and customer experience.

Operational metrics: tools, staffing, manual review

Fraud increases operational complexity. Large merchants often rely on multiple tools, manual reviews, and internal teams to manage risk.

18. Manual review teams handle 1,000–5,000 orders per day at scale.

Operational fraud costs often exceed direct fraud losses

As order volume grows, manual processes become slower, more expensive, and more complicated to scale.

Customer & consumer impact

Fraud directly affects how customers feel about a brand. Even a single incident can erode trust and future spending.

19. About 1/3 of consumers report experiencing online fraud.

Customers who experience fraud are far less likely to return or save payment details.

Fraud harms lifetime value, not just single transactions. Trust is hard to rebuild once lost.

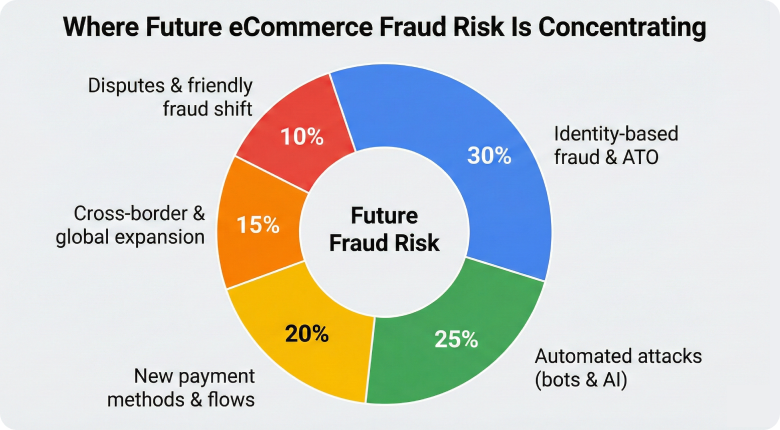

Forecasts & emerging trends to watch

Fraud continues to change as payments, technology, and regulations evolve.

Future fraud risk will shift from stolen cards to identity misuse, automation, and vulnerabilities in new payment flows.

Changing payment methods & risk vectors

New payment methods improve checkout speed but also introduce additional fraud risk.

Fraud groups target payment options with slower settlement or weaker verification.

20. Fraud linked to alternative payment methods has grown by 25–30% year over year.

21. Cross-border transactions carry 2× to 3× higher fraud risk than domestic payments.

Fraud typically first appears in newer payment options before controls catch up.

Merchants that expand payment choices without adjusting risk rules face higher early losses.

Impact of AI and automation on fraud

Automation has changed how fast fraud scales.

Bots and AI tools now test cards, take over accounts, and submit disputes at volume.

22. Automated attacks account for over 40% of detected fraud attempts.

23. Account takeover attempts increased by more than 300% during periods of high automation.

As merchants adopt AI for detection, fraud groups also use AI to bypass rules.

This creates constant pressure to update defenses.

Regulatory & collaboration trends

Stronger authentication rules reduce some types of fraud but shift abuse to others, especially disputes and first-party misuse.

24. Regions with strong authentication rules show up to 60% lower card-not-present fraud rates.

25. Friendly fraud and dispute abuse increase by 15–20% after stricter payment controls.

Fraud prevention now depends more on shared data between merchants, platforms, and payment providers than on isolated controls.

What merchants must prepare for

Fraud will remain a long-term operating risk rather than a short-term issue.

26. Identity-based fraud now accounts for 27–29% of all eCommerce fraud cases and continues to rise.

27. Merchants spend up to 10% of total revenue on fraud prevention, reviews, and dispute management.

Businesses that plan early for identity checks, automation, and dispute handling will reduce long-term losses and protect customer trust.

All your reviews in one place

Collect reviews, manage every response, and display them where they matter most.

Start Free →Conclusion

eCommerce fraud continues to grow and now affects revenue, operations, and customer trust simultaneously. Losses rise even as merchants spend more on prevention.

Friendly fraud and account takeovers now cause more damage than stolen cards, while hidden costs quietly reduce margins.

Merchants that manage fraud as a core business function will protect growth as online sales continue to scale.

Also see:

Frequently asked questions

Card-not-present fraud remains the most common type of eCommerce fraud, but friendly fraud and account takeovers now cause more total losses for merchants.

Friendly fraud increases because customers dispute charges for convenience, forgotten subscriptions, or refund abuse, and banks usually side with the cardholder.

Beyond direct losses, merchants lose about $207 for every $100 of fraud after chargebacks, fees, support time, and blocked real orders.

Yes. Strict fraud rules can block 5–10% of legitimate orders, which is why merchants must balance risk control with customer experience.

Yes. Small and mid-size stores are common targets because they often lack advanced fraud tools and manual review capacity.