Social commerce is now a standard way people shop online. Many buyers discover products on social media and purchase without leaving the app.

With features such as in-app checkout, live shopping, and shoppable videos, social platforms have become full-fledged shopping channels, not just marketing tools.

This blog shares 40 clear social commerce statistics to show how the market is growing, how people shop, and which platforms are leading.

Top highlight

- Global social commerce sales reached $699.4 billion in 2024

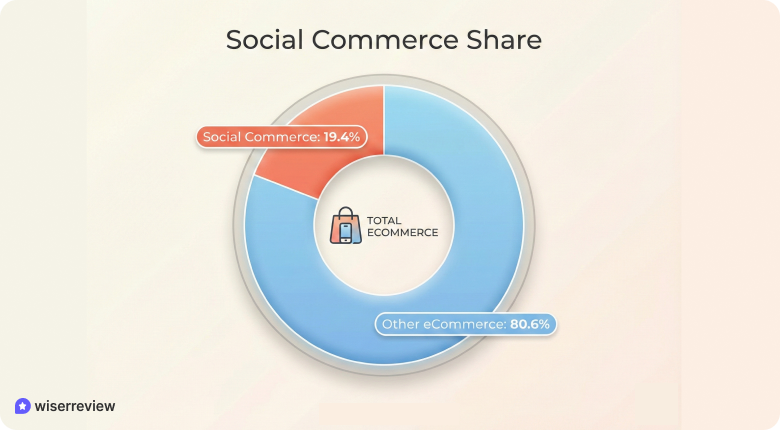

- Social commerce represents 19.4% of global eCommerce sales.

- Asia-Pacific generates over 60% of global social commerce revenue

- China alone contributes approximately $580 billion in GM.V

- Social commerce penetration in China exceeds 90% of consumers.

- TikTok Shop US sales grew by 120% year over year.

- 32% of US online shoppers have purchased via social media

- Influencer recommendations affect 75% of buyer decisions.

- 85–90% of social commerce purchases happen on mobile

- Live-stream shopping generated $682.5 billion in China in one year.

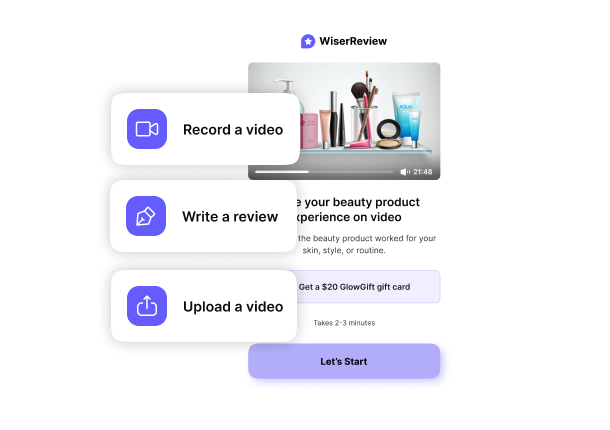

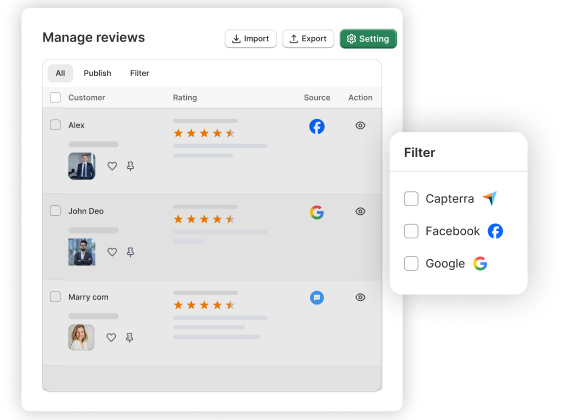

All your reviews in one place

Collect reviews, manage every response, and display them where they matter most.

Market size & Growth

Social commerce is one of the fastest-growing segments of digital retail.

While traditional eCommerce growth has stabilized, social commerce continues to expand at double-digit rates, driven by mobile usage, creator-driven discovery, and frictionless checkout.

Global market value

Social commerce now accounts for a meaningful share of total online retail.

Its value is no longer marginal; it is reshaping how eCommerce revenue is distributed globally.

1. Global social commerce sales reached $570.7 billion in 2023.

2. Global social commerce sales grew to $699.4 billion in 2024.

3. The market grew by 27.2% year over year from 2022 to 2023.

4. Growth remained strong at 22.6% year over year from 2023 to 2024.

5. Social commerce is projected to exceed $1 trillion in annual sales by 2028.

6. Social commerce accounted for 19.4% ofglobal eCommerce sales in 2024.

7. Nearly $2 out of every $10 spent online globally now comes from social commerce.

Regional Breakdowns

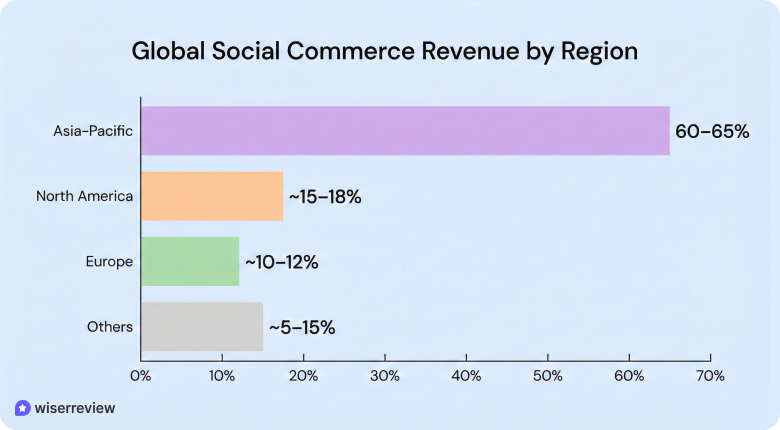

Social commerce adoption varies sharply by region, driven by platform maturity, payment infrastructure, and consumer behavior.

| Region | Share of Global Revenue | Consumer Adoption | Growth Trend |

|---|---|---|---|

| Asia-Pacific | 60–65% | Very High | Rapid |

| North America | 15–18% | Moderate | Steady |

| Europe | 10–12% | Moderate | Gradual |

| Latin America | 6–8% | High | Fast |

| Middle East & Africa | <5% | Emerging | Early-stage |

8. Asia-Pacific accounts for over 60% of global social commerce revenue.

9. China alone generates approximately $580 billion in social commerce GMV.

10. Latin America reports social commerce usage among 62–66% of online shoppers in major markets.

Penetration & Share of e-commerce

Penetration shows how deeply social commerce is embedded in everyday shopping habits.

11. More than 90% of Chinese consumers have purchased through social media platforms.

12. Social commerce represents only 4–5% of total eCommerce sales in the US, leaving significant headroom.

13. Approximately 32% of US online shoppers have made at least one social commerce purchase.

Consumer behaviour & Demographics

This focuses on how people actually behave when shopping through social media.

Planned purchases do not drive social commerce. It is driven by discovery, trust, and ease.

Social commerce fits naturally into daily scrolling habits.

Instead of searching for products, users discover them while consuming content, which shortens decision time and increases impulse purchases.

Shopping via social media platforms

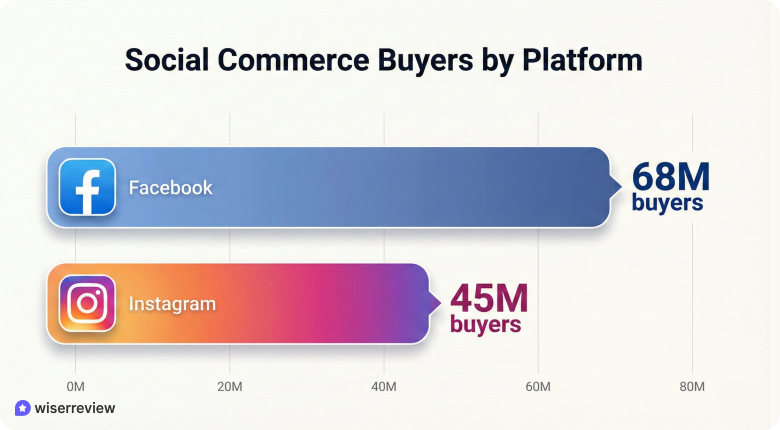

Different platforms attract different types of buyers, but all successful social commerce platforms share three traits: strong discovery, creator-driven content, and simple checkout.

Platforms that feel natural to browse tend to convert better than those that feel transactional.

Users are more likely to shop on platforms where product content blends seamlessly with entertainment and social interaction.

14. Facebook had approximately 68 million social commerce buyers in the US in 2024, making it the largest social shopping platform by user count.

15. Instagram reached around 45 million social shoppers in the US, driven mainly by visual discovery and creator content.

16. TikTok users aged 18–34 account for over 65% of its social commerce audience, highlighting its strength with younger buyers.

17. More than 50% of TikTok users report discovering a new product on the platform.

18. Across platforms, users spend 20–30% more time engaging with shoppable content compared to regular posts.

Purchase drivers & Influence

Social commerce decisions are driven less by brand loyalty and more by trust signals.

Buyers look for real usage, honest opinions, and validation from people they already follow.

Creators, reviews, and social proof reduce uncertainty, which is especially important for impulse-driven purchases.

19. Influencer recommendations influence purchase decisions for 75% of social commerce buyers.

20. Around 58% of consumers have purchased a product after seeing it featured on social media.

21. Creator-led content is trusted 2× more than brand-only advertising.

Payment & Purchase patterns

The payment experience plays a significant role in whether social discovery leads to an actual sale.

The easier the checkout, the higher the conversion.

Impulse buying dominates social commerce, which makes fast, in-app payments essential.

22. In-app checkout increases conversion rates by up to 20% compared to redirecting users to external websites.

23. Mobile wallets and saved payment methods are used in over 70% of social commerce transactions.

24. The average order value for social commerce purchases typically ranges between $30 and $40, reflecting impulse-friendly pricing.

All your reviews in one place

Collect reviews, manage every response, and display them where they matter most.

Start Free →Platforms, formats & Technology trends

Social commerce works best when shopping feels like a natural part of content consumption.

Platforms that combine entertainment, interaction, and simple checkout consistently outperform those that treat commerce as a separate experience.

This section examines the formats and technologies that drive higher engagement, faster decisions, and better conversions.

Platform formats (Live-streaming, In-app shopping, Shoppable content)

Successful social commerce formats reduce friction and increase trust.

Instead of static product pages, users engage with videos, live demos, and interactive posts that show products in real-world use.

Live and shoppable formats create urgency and allow buyers to ask questions, see reactions, and purchase instantly.

25. Short-form video generates 1.5× higher engagement than image-based product posts.

26. Shoppable posts improve click-through rates by 25–30% compared to non-shoppable content.

27. Live-stream commerce generated approximately $682.5 billion in sales in China in 2023.

28. Live shopping accounts for over 60% of total social commerce sales in China.

Mobile & Social-first behaviour

Social commerce is built for mobile. Most discovery, browsing, and purchasing happens on smartphones, which shapes how platforms design checkout, content, and user flows.

Fast-loading pages, one-tap payments, and mobile-first layouts directly impact conversion rates.

29. Mobile devices drive 85–90% of all social commerce purchases globally.

30. Mobile-optimized checkout reduces cart abandonment by up to 15%.

Emerging technologies & Future indicators

New technologies are removing hesitation from online buying.

Features such as augmented reality and AI personalization help shoppers feel more confident in their decisions.

As these tools become standard, they will further close the gap between online and in-store shopping.

31. AR try-on features increase conversion rates by up to 40% in beauty and fashion categories.

32. AI-powered product recommendations increase average basket size by 10–15%.

Industry & Competitive Insights

This explains how brands, retailers, and platforms compete in social commerce. Winning is no longer about spending more on ads.

It’s about how quickly brands adapt to platform behavior, how effectively they work with creators, and how easy it is to make purchases within social apps.

Brands that treat social commerce as a real sales channel, not just a marketing channel, see stronger results across engagement, trust, and conversions.

Brand and retailer performance

Strong performance in social commerce comes from authenticity and execution.

Brands that build native shopping experiences and collaborate with creators outperform those that drive traffic to external websites.

Retailers that design content specifically for each platform convert more impulse-driven buyers.

33. Brands actively selling through social commerce report 30% higher engagement rates than brands using social media only for promotion.

34. Brands using in-app storefronts see 20–25% higher conversion rates compared to external website links.

35. Social-first product launches achieve up to 3× faster sales velocity in the first 30 days.

Marketplace competition & Platform strategy

Social platforms are competing to control the entire buying journey, from discovery through checkout and fulfillment.

This competition is pushing platforms to invest heavily in commerce tools and creator monetization.

Platforms that keep users inside the app have a clear advantage.

36. Social platforms increased investment in commerce infrastructure by over 40% year over year.

37. Platforms that offer a native checkout experience have 15–20% higher purchase completion rates than those that use external redirects.

Regional market nuances & Localisation

Social commerce grows differently across regions. Culture, payment preferences, creator influence, and platform dominance all shape how consumers shop.

Brands that localize content, creators, and payment options outperform those that use a single global strategy.

38. Asia-Pacific accounts for 60–65% of global social commerce revenue, making it the most mature region.

39. In Southeast Asia, over 70% of social commerce purchases are influenced by local creators.

40. Markets with localized payment methods see up to 25% higher conversion rates than markets relying only on global payment options.

All your reviews in one place

Collect reviews, manage every response, and display them where they matter most.

Start Free →Conclusion

Social commerce has become a dominant force in global retail.

With hundreds of billions in annual sales, double-digit growth, and deep integration into everyday social behavior, it is no longer an experimental channel.

The data is precise: brands that invest early in creators, mobile-first experiences, and platform-native checkout will capture the most significant long-term gains.

Social commerce isn’t the next phase of eCommerce; it’s the evolution of how people buy online.

Also see:

Frequently asked questions

Social commerce is the process of discovering and buying products directly through social media platforms like Instagram, Facebook, and TikTok.

Social commerce generates hundreds of billions in annual sales globally and continues to grow faster than traditional eCommerce.

Platforms like Facebook, Instagram, and TikTok lead social commerce, with TikTok growing the fastest among younger shoppers.

Social commerce grows quickly because it combines product discovery, social proof, and in-app checkout, reducing the time between browsing and buying.

Yes, most social commerce purchases happen on mobile devices, as social platforms are designed for mobile-first browsing and checkout.