Your customers browse, they add to cart, they check out, but how much are they actually spending?

This article shares 30 of the latest average order value benchmarks for eCommerce across industries and regions. These numbers help you compare your store with real market data.

If you want to increase revenue without chasing more traffic, these benchmarks show where to focus next. They give you a clear reason to read on and act quickly.

Global benchmark overview

This section gives a clear snapshot of average order value across global eCommerce markets. It shows how AOV varies by region and provides a baseline for comparing your store’s performance.

Latest global AOV figures

1. As of late 2025, the global Average Order Value (AOV) for e-commerce is approximately $150, reflecting a steady increase from previous years.

2. The global average recently settled at $154 in October 2025, which is a 3.08% year-over-year increase from 2024.

3. AOVs peaked significantly in April and May 2025, reaching between $175 and $177.

4. A notable trough occurred in July 2025, where the figure dropped to $45, often attributed to mid-year aggressive discounting cycles or shifting purchase categories.

5. Global Conversion Rate: The benchmark for overall conversion currently hovers between 2.5% and 3%. Performance by device shows significant variance:

Tablets: 3.1% (highest across mobile devices).

Desktops: 2.8%.

Smartphones: 2.3%.

6. The global average Cart Abandonment Rate remains high at 70.22%. Mobile devices see even higher friction, often exceeding 80%.

7. Average customer return rate is approximately 16.9% (with Fashion peaking at 25%).

8. Repeat Purchase Rate: Brands using sustainability claims (ESG) see significantly higher retention, with repeat purchase rates of 32%–34%.

9. Mobile commerce (m-commerce) is projected to account for 59% of all global online retail sales by the end of 2025, totaling roughly $4 trillion in revenue.

10. Global data shows that exceeding 5 steps in the checkout process leads to a 22% increase in abandonment.

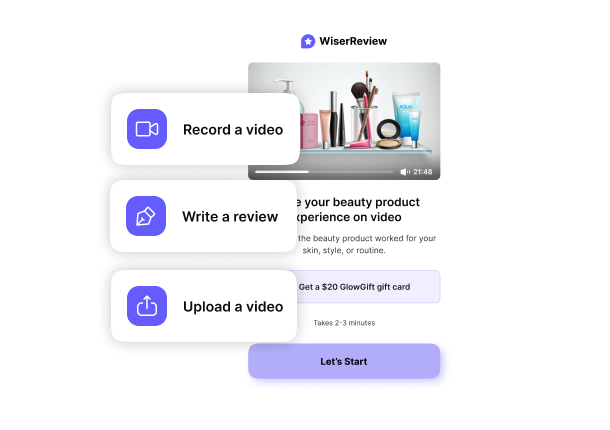

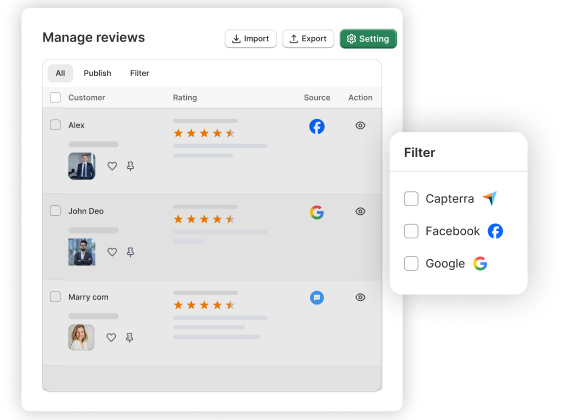

All your reviews in one place

Collect reviews, manage every response, and display them where they matter most.

What drives global variation

In 2025, global variation in Average Order Value (AOV) is driven by macroeconomic conditions, regional infrastructure, and sector-specific consumer behavior.

Macroeconomic drivers

11. Inflation & Disposable Income: High-income regions like North America maintain higher AOVs (approx. $183) due to greater purchasing power.

12. Price Sensitivity: While global inflation has cooled slightly in late 2025, roughly 43% of consumers still prioritize price over brand loyalty.

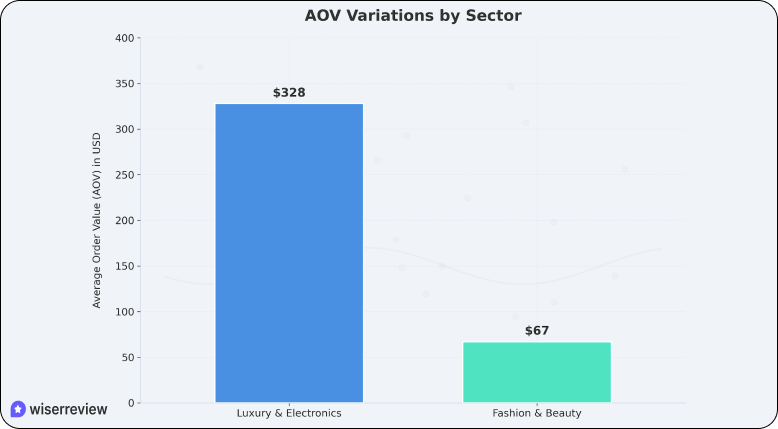

13. Consumer spending behavior: Product categories also shift regional AOVs: luxury and jewelry segments globally report higher figures ($328) versus beauty or pet care ($70–$90).

Regional & infrastructural factors

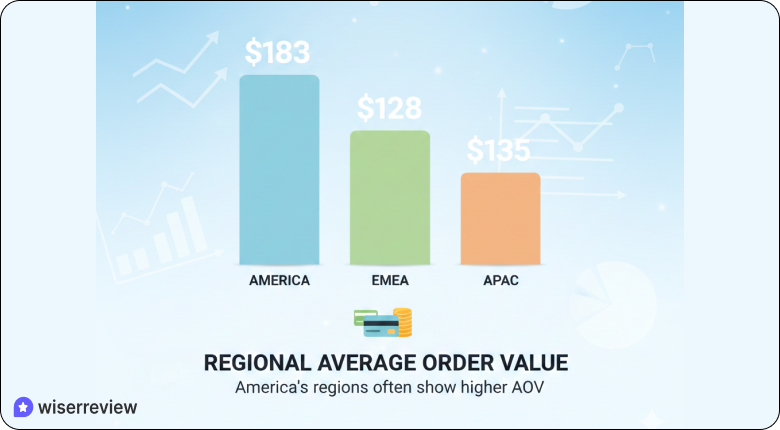

14. Payment Infrastructure: America’s regions often show higher AOV ($183) than EMEA (Europe, the Middle East, and Africa) or APAC (Asia-Pacific region).

15. Logistics & Delivery Expectations: In the US and UK, 90% of customers tend to add products to carts solely to fulfill the free delivery requirements and increase Average Order Value.

Sector & device variations

16. Product Verticality: Luxury and electronics naturally lead global AOV (averaging $328+) because their unit prices are inherently high. Conversely, fashion and beauty maintain lower AOVs (approx. $67) due to lower price points.

17. The “Mobile-Desktop Gap”: Desktop users consistently spend more per order (approx. $192) than mobile users ($133).

Technological adoption

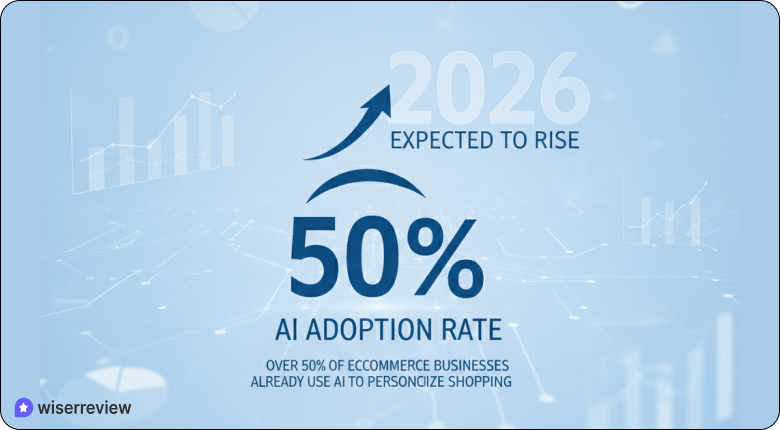

18. AI Personalization: Brands using AI-driven hyper-personalization see an average 10–30% lift in AOV.

19. AI adoption rate: Over 50% of ecommerce businesses already use AI to personalize the shopping experience, and this is expected to rise in 2026.

20. Revenue rate: In some cases, AI can drive revenue boosts of 300% and higher engagement.

All your reviews in one place

Collect reviews, manage every response, and display them where they matter most.

Start Free →Benchmarks by major dimension

By 2025, the global AOV will remain a vital barometer of e-commerce health. Values vary widely across product price points, consumer accessibility, and seasonal demand.

By industry / vertical

The underlying price of goods primarily drives industry benchmarks. Luxury items command the highest values, while high-frequency Beauty products sit at the lower end.

| Industry / Vertical | Average AOV (2025) | Key Characteristic |

|---|---|---|

| Luxury & Jewelry | $328 – $436 | High-ticket items with long buying decisions |

| Electronics | $348 | Expensive gadgets and single large purchases |

| Home & Furniture | $227 – $263 | Project-based buying, often multiple items |

| Consumer Goods | $189 – $296 | Wide mix of daily and household essentials |

| Fashion & Apparel | $97 – $200 | Multiple items per order |

| Food & Beverage | $93 – $147 | Frequent grocery and specialty food orders |

| Pet Care | $67 – $110 | Commodity products with high repeat frequency. |

| Beauty & Personal Care | $67 – $72 | Low-cost items, often single-product refills |

By region/geography

Purchasing power and digital maturity across geographies confer a notable advantage on North America.

| Region / Geography | Average AOV (2025) | Key Insight |

|---|---|---|

| Americas | $183 | Larger baskets are supported by mature logistics and delivery |

| APAC | $135 | High mobile use with frequent, smaller-value orders |

| EMEA | $128 | Mixed markets with steady but lower spend per transaction |

By device or channel

Desktop continues to dominate in order value as it remains the preferred platform for high-consideration and expensive items.

| Device Type | Average AOV (2025) | Strategy Focus |

|---|---|---|

| Desktop | $192 | Use detailed product pages and bundle offers |

| Tablet | $139 | Support relaxed browsing with clear comparisons |

| Mobile | $133 | Push one-click checkout and simple upsells |

By period/seasonality

Monthly fluctuations show a distinct pattern of peaks in late spring and troughs in mid-summer.

| Period / Month | Average AOV (2025) | Seasonal Context |

|---|---|---|

| January | $160 | Post-holiday buying and New Year-driven purchases |

| April / May | $175 – $177 | Peak season with spring shopping and summer prep |

| July | $145 | Lower-value, high-frequency summer sales |

| October | $154 | Early holiday research and gift buying |

By business model/platform type

Direct-to-consumer (DTC) sites typically maintain higher AOVs than large marketplaces like Amazon due to stronger branding and better bundle control.

| Platform / Model | Estimated AOV Range | Competitive Advantage |

|---|---|---|

| Branded DTC | $120 – $150+ | Substantial control over upsells and brand experience |

| Shopify Stores | $120 – $145 | Wide range by niche, standard in apparel, and premium brands |

| Amazon | $52 – $55 | Price-driven, high volume, often single-item orders |

| Multi-brand Retail | Moderate | Better cross-selling across categories |

Interpreting your own AOV vs benchmarks

Benchmarks provide context, but a blind comparison can lead to false conclusions. Your store’s AOV tells a unique story shaped by your specific market position.

How to benchmark your store

Benchmarking is much more than just comparing your numbers against the global average. Calculate your AOV using the simple formula:

Total Revenue ÷ Number of Orders.

Use a multi-layered approach:

1. Vertical Alignment: Compare yourself only to your particular niche. A jewelry brand with an AOV of $100 is underperforming, while a beauty brand with a $100 AOV is an industry leader.

2. Track your AOV across three critical dimensions:

- By traffic source: reveals which channels bring higher-value customers.

- By customer segment: separate new versus returning buyers.

- By device and time: shows when your customers spend the most.

3. Channel-Specific Context: AOV from organic search (SEO) is often higher than AOV from paid social (TikTok/Instagram), as impulse buys tend to result in smaller, single-item baskets.

WiserReview integration: Showcase verified customer reviews at every key decision point throughout your checkout flow. Social proof reflects buyer confidence and directly relates to order value.

When a user sees others buying products like theirs, they are more likely to add complementary items or upgrade to premium options.

What does a “good” AOV mean

A “good” AOV provides sufficient contribution margin to cover your acquisition costs while still leaving a profit.

- Sustainability: A good AOV ensures that your LTV (Lifetime Value) to CAC ratio remains above 3:1.

- Operational Efficiency: Higher AOV reduces the “logistics tax.” It costs nearly the same to pick, pack, and ship a $150 order as it does a $50 order.

- Product Maturity: A rising AOV indicates successful cross-selling and bundling, signaling that customers trust your brand enough to purchase more than just the “hero” product.

Common pitfalls and misreads

Avoid these common traps when analyzing your data:

- The “Discount Trap”: Raising AOV through “Buy More, Save More” promos can be a false positive. If you increase AOV by 20% but decrease your gross margin by 25% through heavy discounting, you are losing money on every extra item sold.

- Ignoring Returns: High-AOV industries (such as Apparel) often suffer from “bracket shopping” (purchasing multiple sizes to maximize returns). If your AOV is $300 but your return rate is 40%, your Net AOV is actually much lower.

- Neglecting industry context: Comparing your AOV to a different sector can give false signals. A beauty store should not compare itself with electronics or luxury.

- Overlooking device split: Mobile-heavy stores often show lower AOV. Comparing with desktop-led benchmarks can make performance look weaker than it is.

- Missing the review impact: The absence of customer review visibility results in lower AOV in stores than in stores where reviews are visible.

WiserReview addresses this issue by automatically gathering and displaying reviews where they are most important: on products, in the cart, and at checkout.

All your reviews in one place

Collect reviews, manage every response, and display them where they matter most.

Start Free →Wrap up

Average order value benchmarks put matters into context, not targets to copy. What matters is how your AOV performs within your industry, region, device mix, and business model.

Use these 30 benchmarks to spot gaps, test smarter pricing and bundles, and improve checkout and trust signals where they matter most.

The reason is that small AOV gains compound into real revenue growth without chasing more traffic.

Focus on sustainable improvements over quick spikes. When you combine clear benchmarks with better buyer confidence and strong social proof, AOV is more of a growth lever than it is a metric.

Also see:

Frequently asked questions

The global eCommerce average order value is about $144.5–$150 as of late 2024–2025.

Desktop AOV is higher, at around $122–$155, while mobile is $86–$112 per order.

Luxury and jewelry lead with high AOV (about $323+), followed by home and furniture, and then broader consumer categories.

B2B orders are much larger, often $500–$1,000+ per order for routine purchases, while B2C usually ranges from $60–$150 depending on the sector.