Ecommerce returns and refunds now shape how people choose where to shop. Customers expect easy returns, fast refunds, and clear policies.

At the same time, returns impose high costs and risks on retailers.

This blog breaks down the latest 2026 ecommerce return and refund statistics.

It covers scale, behavior, product categories, costs, fraud, and policy trends using clear data points.

Top highlight

- Around 17–18% of online orders get returned on average.

- In-store return rates stay lower at 8–10%.

- US retail returns crossed $740 billion in a single year.

- Global ecommerce returns exceed $640 billion annually.

- Apparel return rates range from 20% to 30%, with some segments reaching 50%.

- More than half of returns happen due to size or fit issues.

- Most refunds take 9–10 days from return to completion.

- 85% of shoppers expect refunds within one week.

- Return fraud causes over $100 billion in losses each year.

- Free return policies can double return rates in some regions.

All your reviews in one place

Collect reviews, manage every response, and display them where they matter most.

The scale of ecommerce returns & refunds

Ecommerce returns now happen at a scale that directly affects revenue, operations, and customer experience.

Online shopping drives higher return rates than physical retail, refund volumes continue to grow each year, and processing refunds has become a significant workload for retailers.

This section explains the scale of the return problem and the sources of pressure.

Global and regional return rates

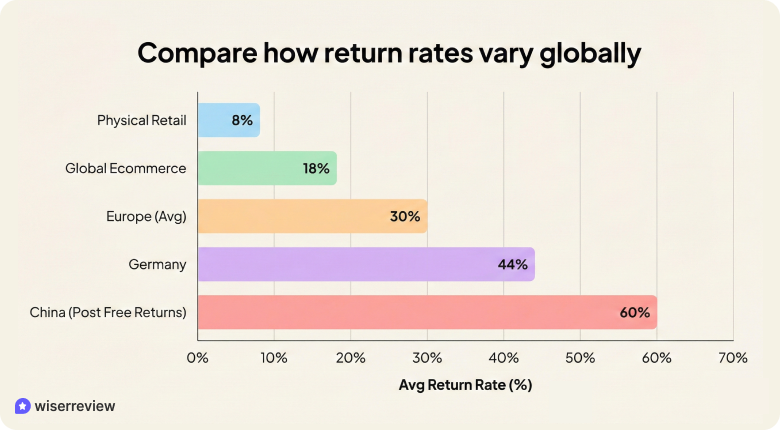

Online orders are returned far more often than in-store purchases.

1. Most ecommerce stores see return rates between 15% and 20%, while physical retail stays much lower.

Europe records the highest return rates worldwide.

2. Many European countries experience return rates of 25–40% for online orders.

3. Germany leads, with rates near 44%, driven by strong consumer protection laws and easy, free returns.

Asia shows rapid growth in returns.

4. In China, once free returns became common, some product categories saw return rates rise from around 30% to nearly 60%.

This shows how policy changes directly shape customer behavior.

Total value of returned merchandise

Returns are no longer a minor cost. They now represent one of the largest financial drains in ecommerce.

5. In the US alone, annual returns have exceeded $740 billion, with projections approaching $900 billion.

6. On a global level, ecommerce returns exceed $640 billion each year.

Seasonal sales make the problem worse.

7. Holiday shopping increases return volume by 15–17%, and January consistently becomes the busiest return month as customers send back gifts and unwanted items.

Refund processing volumes

Refund processing places a heavy operational burden on retailers.

Large ecommerce brands process millions of refunds each month, especially after sales events and peak seasons.

8. Once a return is received, most refunds take 1–7 business days to process.

9. When shipping and inspection time are included, the full refund cycle averages 9–10 days.

These delays often lead to customer frustration and support tickets, making the speed of refunds a key performance metric.

Return behaviour by product category

Return rates vary widely by product type. Items that depend on fit, appearance, or personal preference see far more returns.

Products that are bulky, regulated, or subject to more rigorous research see fewer returns.

This breaks down which categories face the highest return risk and why others perform better.

Highest-return categories

Products in this group are hard to evaluate online. Customers often order multiple options and return the ones that do not work.

| Product Category | Average Online Return Rate | Main Return Reasons | Key Risk Drivers |

|---|---|---|---|

| Clothing & Fashion | 20–30% (up to 50% in luxury) | Size, fit, color mismatch | Bracketing, style uncertainty, and inconsistent sizing |

| Footwear | 15–20% | Comfort and sizing issues | Fit differences between brands |

| Accessories | 10–12% | Style mismatch | Visual expectations vs reality |

| Fast Fashion | 25–35% | Impulse buying | Low price, trend-driven demand |

| Luxury Apparel | 40–50% | Fit and buyer hesitation | High price, comparison shopping |

Fashion leads all categories in returns. Customers often treat delivery as a fitting room. High style variety, inconsistent sizing, and free return policies increase return frequency.

Lower-return categories and why they differ

These categories involve greater intent, stricter rules, or greater return on effort.

| Product Category | Average Online Return Rate | Why Returns Are Lower | Buyer Behavior |

|---|---|---|---|

| Consumer Electronics | 5–10% | Research before purchase | Specification-driven decisions |

| Furniture & Home Goods | Around 8% | High shipping cost | Fewer impulse buys |

| Appliances | 4–7% | Installation complexity | Longer decision cycles |

| Beauty & Personal Care | 1–5% | Hygiene restrictions | Careful product selection |

| Grocery & Consumables | Under 2% | Expiry and safety limits | Rare discretionary returns |

Lower-return categories benefit from precise specs, high friction for returns, or safety rules.

Customers spend more time deciding and encounter real limits when returning items, reducing abuse.

Emerging categories & cross-border returns

New ecommerce categories and international orders are more likely to experience return issues.

People buy faster, product details are limited, and returns are more difficult. These factors push return risk higher.

10. Emerging categories such as social commerce, influencer-led products, and fast-fashion stores have 20–35% return rates, higher than those of most ecommerce products.

11. Cross-border orders have 30–50% fewer returns than domestic orders, primarily because customers avoid high shipping costs or additional steps.

12. Refunds for international orders typically take 2 to 3 times longer than local refunds due to shipping delays and customs clearance.

13. 25–30% of international shoppers abandon the return process when they see return fees or complex instructions.

These numbers show that new and international ecommerce sales face higher return rates, even when customers do not always return products.

All your reviews in one place

Collect reviews, manage every response, and display them where they matter most.

Start Free →Consumer expectations & Refund behaviour

Customer expectations around returns and refunds are now set. Shoppers expect free returns, fast refunds, and simple steps.

These expectations shape how people buy, return, and even misuse policies. The points below mix precise data with short explanations.

Free returns and consumer demand

Free returns reduce risk for buyers and increase trust. Shoppers check return rules before buying and often decide based on how easy returns feel.

Free returns strongly affect where people shop.

14. 76% of online shoppers say free returns influence their buying choice

When shoppers know they can return items at no cost, they feel less risk and buy more confidently.

At the same time, return rules must be clear.

15. 60% of customers abandon a purchase if the return policy feels confusing or too strict.

Long policy pages or hidden fees often stop buyers at checkout.

Speed of refunds/exchanges

Refund speed now shapes customer satisfaction and loyalty. Long refund times cause frustration even when returns are approved.

Refund speed now matters almost as much as the product itself.

16. 85% of shoppers expect their refund within one week or less.

Waiting longer creates frustration, even if the return was approved.

Expectations are getting tighter.

17. 45% of customers expect a refund within 3 days of returning an item.

Stores that process refunds faster often see higher repeat purchases and fewer support requests.

Behavioural trends: “bracketing”, “wardrobing” and policy abuse

Many shoppers plan returns. Easy policies encourage over-ordering and, at times, abuse.

Many shoppers plan returns before they buy.

18. 63% of online shoppers admit they order multiple sizes or versions and return what they do not want.

This is most common in clothing and footwear.

Younger shoppers do this even more.

19. About 50% of Gen Z buyers say they often buy extra items knowing they will return some.

Social shopping and fast trends make this behavior common.

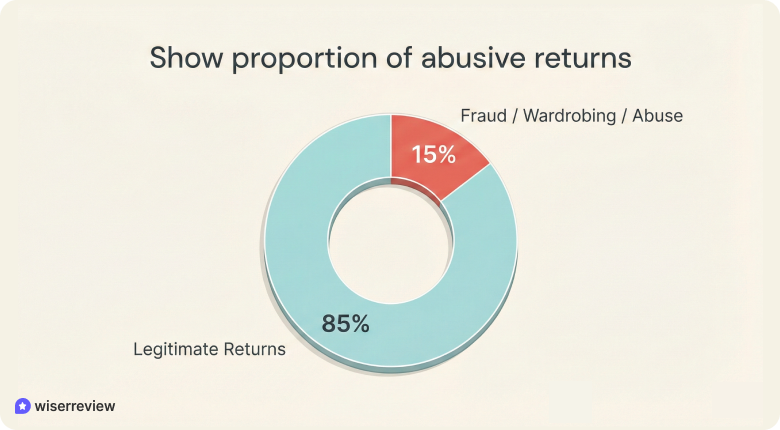

Policy abuse adds another problem.

20. 10–15% of all returns are linked to fraud, wardrobing, or repeated misuse of return rules.

A small group of shoppers accounts for most of the losses, prompting retailers to tighten policies.

Cost & Operational impact on retailers

Returns not only affect customer experience. They create direct costs, reduce profits, increase waste, and create opportunities for fraud.

This section explains how returns affect retailer operations, using clear statistics and concise explanations.

Cost per return/cost of the returns process

Every return creates cost beyond the refund itself. Shipping, handling, inspection, and support all add up.

21. Each return costs retailers between $10 and $65, depending on product type and shipping distance.

Low-value items often cost more to return than they are worth, which hurts margins.

22. Reverse logistics costs can consume 20–30% of the original product value for many ecommerce orders.

This includes transport, labor, repackaging, and system handling.

Impact on resale margin, waste, and sustainability

Many returned items cannot be sold again at full price. This affects profit and creates waste.

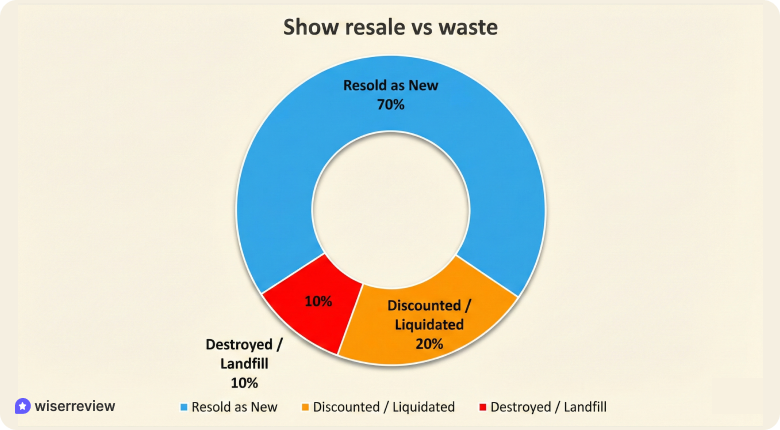

23. Over 30% of returned items cannot be resold as new due to damaged packaging or signs of use.

These products are often discounted, liquidated, or destroyed.

24. Apparel and footwear returns generate some of the highest waste, as many items end up in landfills rather than being resold.

Returns increase transport emissions and environmental impact with every shipment.

Fraud, abuse, and retailer losses

A small group of shoppers causes a large share of return losses. Fraud and abuse are now forcing retailers to tighten their rules.

25. Return fraud accounts for 10–15% of total return volume across ecommerce.

This includes wardrobing, false damage claims, and empty box returns.

26. Retailers lose over $100 billion per year from return fraud, abuse, and policy exploitation combined.

Repeat offenders cause most losses, not one-time customers.

Return & Refund policy trends

Return and refund policies are constantly evolving as retailers try to balance customer expectations with rising costs.

In 2026, most brands adjust policies to protect margins while keeping returns easy enough to avoid losing customers.

Popular return policy features & benchmarks

Retailers now follow similar return policy patterns to stay competitive and control costs.

27. Most ecommerce brands offer a 30-day return window as the standard policy length.

Shorter windows reduce late returns, while longer windows increase return volume.

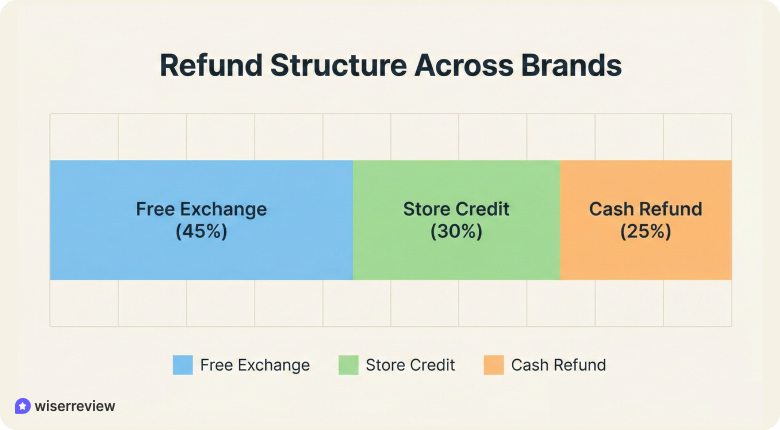

28. Over 60% of ecommerce brands offer free exchanges, while only 30–40% offer free refunds, since exchanges help protect revenue.

Many brands issue refunds in store credit instead of cash.

Impact of policy generosity vs margin protection

Flexible policies help conversion but also increase costs and the risk of abuse.

29. Generous return policies increase conversion rates, but they also raise return volume by 20–30% in some categories.

Brands now limit free returns on low-margin or high-return products.

Retailers that tighten policies too much often see higher cart abandonment and lower repeat purchases.

Reverse logistics and automation adoption.

Automation helps retailers manage high return volumes without raising costs.

30. Automation in return handling can reduce processing time by up to 50%, lowering labor costs and refund delays.

Tools like return portals, automated approvals, and fraud checks now play a key role in scaling returns.

All your reviews in one place

Collect reviews, manage every response, and display them where they matter most.

Start Free →Conclusion

Returns and refunds now play a key role in how people shop online.

Customers expect free returns, fast refunds, and clear return policies, and many plan their returns before making a purchase.

For retailers, returns reduce profit, raise costs, and increase fraud and waste. High return volume also puts pressure on operations.

Brands that keep policies clear, process refunds quickly, and prevent abuse can protect margins and maintain customer trust.

Also see:

Frequently asked questions

Most online stores see return rates between 15% and 20%, which is much higher than physical retail.

Clothing, footwear, and fashion accessories have the highest return rates due to size, fit, and style issues.

The main reasons are poor fit, items not matching expectations, damaged products, and easy return policies.

Most refunds are completed within 7–10 days, including shipping and processing time.

Clear product details, free exchanges, faster refunds, and return automation help reduce costs and abuse.