Online shopping is booming, but it’s not the same everywhere. From how people shop to what they buy, each country has its own trends and surprises.

In 2026, online shopping will reach new dimensions with some countries at the forefront and many close behind.

In the article, we have extracted 77 key statistics that reflect the current state of online shopping in the global market.

Want to know the players who change the game? Well, let’s dig deeper.

Quick highlight

Approximately 33% of the world’s population (2.77 billion people) are now digital buyers, a figure expected to grow to nearly 2.86 billion in 2026.

- 2.77 billion people worldwide will shop online in 2026.

- Online shopping’s share of total retail is projected to be around 21.5% in 2026.

- Mobile commerce will continue to grow strongly, projected to reach around $2.8 trillion in 2026.

- Mobile commerce (mCommerce) is expected to account for 59% of total online retail sales.

Global overview of online shopping

Online shopping continues to grow rapidly, with global ecommerce revenue set to reach roughly $6.88 trillion in 2026. This sector now accounts for approximately 21% of all global retail sales, a figure expected to climb to 22.9% by 2028.

Total size of online shopping and growth trends

The industry continues to expand, though it has entered a “normalization” phase following the pandemic-era surge.

1. Global Retail Sales: Estimated between $6.42 trillion and $6.86 trillion.

2. Total B2B E-commerce: Significantly larger than the consumer market, valued at approximately $32.11 trillion in 2026.

3. Market Concentration: China remains the dominant market, accounting for roughly 50% of global online sales, followed by the United States and Western Europe.

Growth Trends;

4. 21.1%Share of total retail sales that e-commerce represents

5. 2.77 billion Global online shoppers (approximately 1/3 of the world population)

6. 7.2% Year-over-year growth rate from 2025 to 2026

7. $8.91 trillion Projected market size by 2030

Key factors driving growth

8. Mobile Commerce (mCommerce): Smartphones account for nearly 80% of global retail website traffic.

9. AI and Personalization: Roughly 51% to 72% of successful e-commerce companies utilize AI for personalized recommendations and automated customer service.

10. Social Commerce: Selling through platforms such as Facebook, Instagram, and TikTok is a major driver, with global social commerce sales projected to reach $1.17 trillion in 2026.

11. Consumer Expectations: Shoppers increasingly prioritize free and fast delivery; 79% are more likely to shop online if free shipping is offered, and over 60% expect delivery within 1–2 days.

All your reviews in one place

Collect reviews, manage every response, and display them where they matter most.

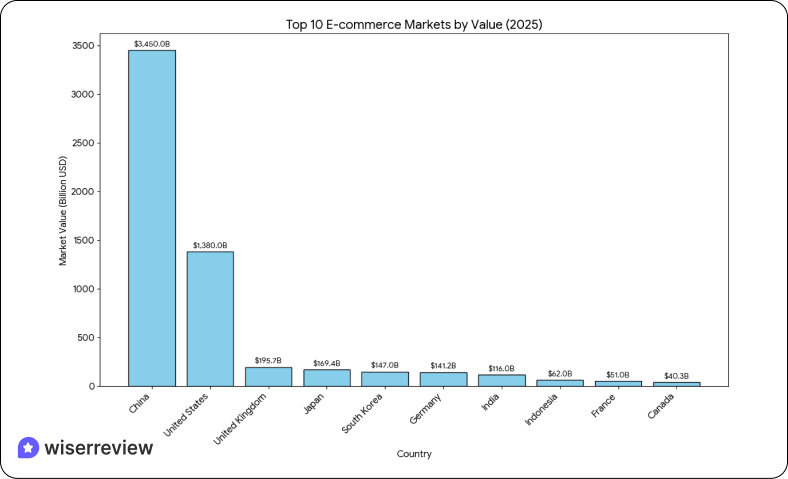

Top 10 countries by online shopping revenue

Gglobal online shopping revenue will be driven by a handful of superpower nations, with the top 10 countries accounting for most of the world’s estimated $6.42 trillion to $6.86 trillion in total online retail sales.

Methodology and criteria for selection

Our rankings are based on 2026 e-commerce figures in USD billions – that’s total online retail transactions within each country. We’re discussing B2C e-commerce across a range of products and major platforms.

- Total Online Sales: Rank countries by how much money shoppers spend online in a year.

- E-Commerce Penetration: Measure the percentage of retail sales conducted online.

- Growth Rate: Check how fast online shopping revenue is rising year over year.

- Consumer Adoption: Consider internet use, mobile shopping, and the ease of online payments.

- Digital Infrastructure: Assess the strength of a country’s internet, apps, and delivery systems.

- Data Sources: Use trusted reports from official stats, industry research, and platforms to compare accurately.

Country profiles

Here are current, accurate market value profiles for the top 10 countries by market value and the highlights;

1. China – Largest Online Shopping Market

China leads global e-commerce with the largest market by far. In 2026, revenue reached $1.38 trillion and is projected to grow at a 10.42% CAGR, exceeding $1.53 trillion in 2026.

Market value (2026): $3.45 trillion in ecommerce sales.

Market highlights

12. China has an estimated over 900 million digital buyers.

13. 84% of purchases are made using digital wallets such as Alipay and WeChat Pay.

2. United States – Second-largest growing market

Driven by Amazon and eBay, the U.S. remains the primary hub for e-commerce innovation and the second-largest market globally.

Market value (2026): $1.38 trillion in online sales.

Market highlights

14. Around 80% of U.S. adults shop online.

15. Accounts for approximately 19% of the globe’s total e-commerce sales.

3. United Kingdom – The highest penetration rates globally

Boasts one of the highest online shopper penetration rates globally, with Amazon UK and Argos as key players.

Market value (2026): $195.7 billion

Market highlightsThe

16. The UK had about 57 million online shoppers.

17. The UK has one of the highest national online store penetration rates globally (30.6%).

4. Japan – A high number of internet users

A mature market where consumers prioritize quality and reliability. Rakuten and Amazon Japan are the dominant platforms.

Market value (2026): $169.4 billion.

Market highlights

18. Japan has over 94 million Online shoppers, which is 76% of the population.

19. Amazon Japan (US$12.83 billion in annual sales), Apple (US$3.61 billion in annual sales), and Yodobashi (US$2.50 billion in annual sales) are the top e-commerce brands in Japan.

5. South Korea – Highly advanced in mobile commerce

Noted for having the world’s fastest wireless internet and high smartphone penetration. Top sites include Gmarket and Coupang.

Market value (2026): $147 billion.

Market highlights

20. Online sales 2026 revenue – $78.04 billion, targeting 10%+ growth in 2026.

21. 30% penetration; Coupang holds US$18.25 billion annual sales

6. Germany – Europe’s second-largest e-commerce market

Europe’s second-largest market. “Buy now, pay later” is the most popular payment method, and Otto is a major local competitor to Amazon.

Market value (2026): $141.2 billion

Market highlights

22. Online sales revenue in 2026 is $89.71 billion and is projected to rise 8% in 2026.

23. Otto and Zalando are key players, with widespread adoption of 20% BNPL.

7. India – Fastest-growing market globally

One of the world’s fastest-growing markets, fueled by rapid digital adoption and a massive base of new mobile shoppers, is projected to become the third-largest online retail market by 2030.

Market value (2026): $116 Billion

Market highlights

24. India had a 690 million Internet user base in 2023, which is 40% of the population.

25. The e-commerce market size was $147.3 billion in 2024 and is projected to grow at an 18.7% CAGR through 2028.

8. Indonesia – The largest e-commerce market in Southeast Asia

The largest e-commerce market in Southeast Asia, with growth driven by rising smartphone usage and a young demographic. Digital wallets (GoPay, OVO, Dana) are the leading payment method.

Market value (2026): $62 Billion

Market highlights

26. Mobile apps are used for 67% of online purchases.

27. Ecommerce volume is projected to reach US$75 billion in 2024, with a 19% CAGR by 2027.

9. France – Fashion and luxury growing market

France is a key player in the EU for e-commerce, and we see strong demand for ‘click-and-collect’ services and second-hand shopping, driven by growing awareness of sustainability.

Market value (2026): $51 Billion

Market highlights

28. Average annual spend per online shopper is $2,450.

29. Popular platforms include Amazon FR (US$5.14 billion in annual sales) and Shein (US$1.75 billion in annual sales).

10. Canada – High internet penetration market

The region is highly internet-penetrated, with a market largely dominated by Amazon Canada and Walmart Canada. Consumers tend to cross-shop due to their proximity to the U.S. marketplace.

Market value (2026): $40.3 Billion

Market highlights

30. 55.5% cross-border rate, the highest cross-border purchase rate in North America.

31. Credit cards account for 64% of online payments.

Comparative table of the top 10

| Rank | Country | Projected 2026 Revenue (USD) | Online Share of Total RetaiL | Primary Growth Driver |

|---|---|---|---|---|

| 1 | China | $2.53 – $3.45 Trillion | 47.3% | Social Commerce & Mobile Wallets |

| 2 | USA | $1.19 – $1.47 Trillion | 15.9% | Omnichannel Retail & Subscription Models |

| 3 | UK | $195.7 Billion | 28.0% | High Consumer Adoption & Density |

| 4 | Japan | $169.4 – $190.5 Billion | 10.0% | Tech-Savvy Aging Population |

| 5 | South Korea | $147 – $207.7 Billion | 18.0% | Hyper-Fast Delivery & Mobile Apps |

| 6 | Germany | $141.2 Billion | 11.2% | Durable Goods & BNPL Adoption |

| 7 | India | $116 – $125 Billion | 5.0% | Smartphone Expansion & Quick Commerce |

| 8 | Indonesia | $62 – $65 Billion | 5.4% | Mobile-First Gen Z & Social Commerce |

| 9 | France | $51 – $113.7 Billion | 10.0% | Fashion & Cross-Border EU Trade |

| 10 | Canada | $40.3 – $65.5 Billion | 13.6% | Increased International Shipping Options |

Observations & take-aways

Projections for the top 10 e-commerce markets in 2026 indicate a continued shift toward mobile and social-led shopping.

32. In 2026, global retail e-commerce sales are projected to reach approximately $6.88 trillion, a 7.2% increase from 2026.

33. Online sales are expected to account for 21.1% of total global retail by the end of 2026.

34. China and the US account for the majority of global sales, together representing over $2.3 trillion, roughly one-third of the global market.

35. Revenue from social shopping channels is projected to approach $2.9 trillion globally by 2026.

36. The global B2B e-commerce market is set to reach $36.16 trillion by 2026, growing at a 14.5% CAGR.

37. Nearly 90% of e-commerce sales come from just the top 10 markets.

All your reviews in one place

Collect reviews, manage every response, and display them where they matter most.

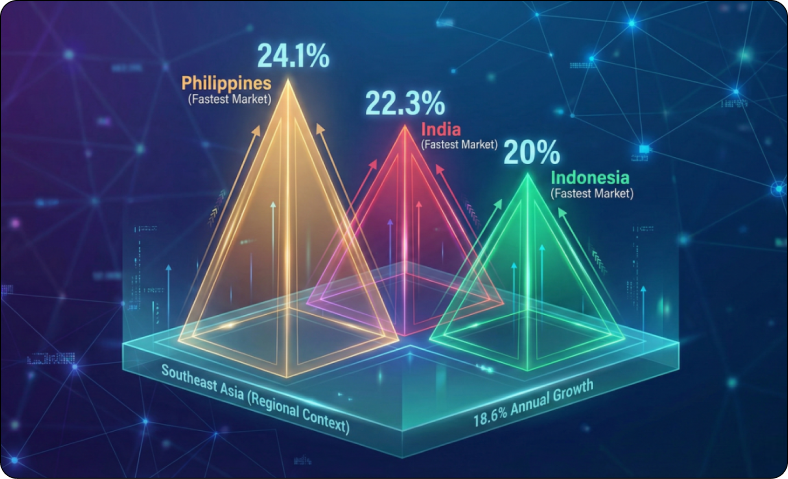

Start Free →Penetration & growth by country (Emerging markets focus)

Emerging markets hold the key to e-commerce growth, as large populations are rapidly digitalising and going online.

Why focus on emerging markets?

Emerging markets represent the “new growth frontier” – expected to drive global e-commerce growth through 2027.

38. With over 64% of growth opportunities originating from these regions.

39. Approximately 90% of the world’s Millennials and Gen Z consumers will reside in emerging markets by 2027.

40. Emerging markets (EMs) are the primary engines of global e-commerce, with their collective output accounting for 50.6% of global GDP.

41. Southeast Asia leads growth at 18.6% annually; the Philippines (24.1%), India (22.3%), and Indonesia (20%) are the fastest-growing markets.

Country deep-dives

Now, let’s dive into the countries where eCommerce markets are growing rapidly.

42. The Philippines leads all nations in growth velocity with 24.1% annual growth, driven by a young, tech-savvy population and platforms like Shopee and Lazada.

43. India follows closely at 22.3% growth, with over 700 million internet users.

44. Indonesia ranks third in growth at 20%, with a population of over 270 million and e-commerce platforms like Tokopedia, Bukalapak, and Shopee.

45. Vietnam is experiencing 12.5% annual growth, with companies like Tiki and Shopee integrating social commerce through platforms like Zalo.

46. Brazil, Leading South American growth, with its e-commerce value expected to exceed $200 billion by 2026.

47. Nigeria represents Africa’s e-commerce frontier, with platforms like Jumia and Konga with 26% of total revenue in 2024.

Barriers & opportunities in these markets

Key Barriers

48. Infrastructure gaps: Sub-Saharan Africa has <50% internet access, and rural last-mile delivery costs are 300% higher than in urban areas.

49. Logistics challenges: Underdeveloped roads/warehouses cause delays; Nigeria faces traffic congestion and unreliable couriers in rural zones. 61% population still faces mobile internet crisis.

50. Payment & trust issues: 20% rise in online fraud (Southeast Asia, 2020-2023); cash-on-delivery remains dominant due to low banking penetration.

Key Opportunities

51. Mobile ecommerce is forecast to account for 75% of online shopping by 2026. Opportunity: Optimizing mobile stores, apps, and payment flows can drive higher revenue

52. Social commerce sales were estimated at $1.2 + trillion in 2026. Opportunity: Companies selling directly through social platforms (Instagram, TikTok, live streams) can capitalize on a rapidly growing sales channel.

53. Ecommerce is expected to account for 21.1% of all global retail sales in 2026. Opportunity: The expanding pie means more demand and room for new and existing ecommerce businesses to grow.

54. The global B2B ecommerce market is expected to hit $36 trillion by 2026. Opportunity: Companies selling wholesale or to other businesses can expand their online service offerings and platforms beyond B2C.

55. More than 92% of top ecommerce sites use AI for personalization. Opportunity: Personalized search, recommendations, and AI-driven marketing boost engagement and sales.

Projected future size

The long-term outlook for emerging markets suggests a permanent shift in the global retail hierarchy.

56. Global e-commerce sales are forecast to reach about $6.88 trillion in 2026.

57. Revenue from social media shopping is expected to reach $2.9 trillion by 2026.

58. By 2028, ecommerce is expected to account for around 22.5% of global retail sales (up from 21.1% in 2026).

59. The B2C ecommerce segment is projected to grow to $9.3 trillion in 2026.

60. Latin America is projected to continue growing at 12-14% annually, with retail e-commerce sales reaching $608 billion by 2027.

India is projected to surpass the U.S. to become the world’s second-largest e-commerce market by 2034.

Consumer behaviour and demographic differences by country

Consumer behavior varies significantly across regions, driven by local infrastructure, cultural habits, and technological adoption.

Frequency and habits of online shopping

Online shopping has become routine for most global consumers.

61. 34%of global shoppers make online purchases at least once a week

62. 31% of consumers shop online once a month, the largest group globally, and 24% of buyers shop online every two weeks.

63. Approximately 79% of digital shoppers make at least one purchase per month.

64. 81% of retail shoppers research online first, before buying.

Cross-border online shopping: country insights

International shopping is a significant growth driver, with 52%-59% of global shoppers purchasing from international businesses in 2026.

65. China dominates the cross-border e-commerce market with 51.1% of the world’s e-commerce sales.

66. 24% Global shoppers’ most recent cross-border purchases were made on Amazon

67 50%Amazon’s gross merchandise value from international sources

68. 38% of cross-border online purchases are delivered in 5 days

69. 56.7% Singapore’s cross-border purchase rate (highest globally)

Device & payment method preferences

The shift toward mobile-first commerce is nearly complete, though desktop remains critical for high-value transactions.

70. Smartphones account for 60% to 70% of all global e-commerce sales in 2026. Mobile usage is highest in China (92%) and India (88%).

71. Despite higher mobile traffic, desktops still have higher conversion rates (around 2.8%) than smartphones (2.3%).

72. Digital wallets are the dominant payment method, accounting for 53% of all global online transactions in 2026.

Age, income, urban vs rural differences

While detailed country-level demographic breakdowns are limited, research indicates that emerging markets have younger, more tech-savvy populations, with median ages under 30 in Southeast Asia and India, which drives mobile-first e-commerce adoption.

Urban areas lead rural regions in e-commerce adoption, though this gap is narrowing as internet infrastructure expands.

Key demographic insights:

73. 78% – 16–24-year-olds using mobile payments in the UK

74. 67% – 25–34-year-olds registered for mobile payment services

75. 24% – 55–64-year-olds with mobile payment adoption

Income Influences: Higher-income individuals are more likely to prefer e-commerce for its convenience and variety. At the same time, lower-income earners in some regions still show a stronger preference for brick-and-mortar stores.

What they buy online: product categories by country

While general trends exist, specific categories lead in different major markets:

76. Electronics dominate globally, with forecasted spending of $922.5 billion, driven by smartphones, computers, smart home devices, and consumer electronics.

77. Fashion and apparel rank second at $760 billion, with strong adoption across developed nations and rapid growth in emerging markets.

Category preferences vary by region:

- Japan & South Korea: Consumer electronics, beauty products

- Germany & France: Fashion, home furnishings, sporting goods

- India: Food and beverage e-commerce (platforms like Reliance JioMart)

- Southeast Asia: Fashion, electronics, fast-moving consumer goods (FMCG)

- Brazil: Home improvement, furniture, and real estate-driven purchases

- UK: Food, Fashion, Household goods.

All your reviews in one place

Collect reviews, manage every response, and display them where they matter most.

Implications for marketers, retailers & consumers

As the global e-commerce market is expected to reach $6.88 trillion by 2026, its pretty clear that there are some major implications for anyone in the retail ecosystem, here are the key takeaways.

For global brands and e-commerce platforms

Adapt products by market: Global brands must tailor offerings for each country’s preferences, pricing, and cultural trends.

Predictive Operations: By 2026, global brands will use AI for real-time demand forecasting and automated pricing intelligence, reducing errors by 25–30%.

Invest in mobile experiences: With ~60–75% of ecommerce sales on mobile, seamless mobile checkout and app engagement increase conversions.

Focus on logistics and delivery: Fast, reliable delivery options build trust across borders and reduce cart abandonment.

For local/ national retailers

Compete on relevance: Local retailers can win by understanding local habits, payment preferences, and language needs.

Optimize for local delivery: Faster local delivery and easy returns make online shopping more attractive than distant competitors.

Leverage digital payments: Offering popular local payment methods (e.g., wallets, local gateways) increases conversion.

Highlight trust factors: Clear policies, local reviews, and customer service help build credibility with local shoppers.

For consumers

More choice and convenience: Online shopping gives consumers access to a broader product range and better price comparisons.

Faster, more flexible delivery: Same-day and next-day options improve satisfaction.

Data privacy matters: Consumers should be aware of how their data is used and value platforms with strong privacy and security.

Better deals and personalization: Personalized offers, wish lists, and loyalty programs help shoppers save money and time.

For policy-makers and infrastructure planners

Improve internet access: Expanding broadband and mobile coverage increases ecommerce participation, especially in rural areas.

Support secure payment ecosystems: Encouraging secure, interoperable digital payment systems builds trust and growth.

Update regulations: Clear rules for taxation, cross-border trade, and consumer protection support fair competition.

Strengthen logistics infrastructure: Efficient roads, ports, and parcel networks reduce delivery time and costs for both sellers and buyers.

Wrap up

Online shopping is no longer a single global pattern. It is shaped by country-level behavior, infrastructure, and digital maturity.

The data shows clear gaps between mature and emerging markets. Mobile use, payments, delivery speed, and trust now define who grows faster.

Growth for the brand and retailers comes from local insights, not necessarily from scale. Successful markets are where strategy and shopping behavior meet.

These country-level reports are not just numbers; they also provide guidance on planning expansions, innovations, and growth beyond 2026.

Also see:

Frequently asked questions

China is expected to remain the largest e-commerce market, with sales projected to reach over $3 trillion by 2026.

Mobile shopping is rapidly growing, with projections showing it will account for 59% of total online retail sales by 2026.

It's a mix of mobile commerce, using AI for personalisation, social media commerce, and basically just getting orders to customers super quick and reliably.

India, Indonesia, and Southeast Asian countries are growing rapidly, with annual growth rates exceeding 20%.